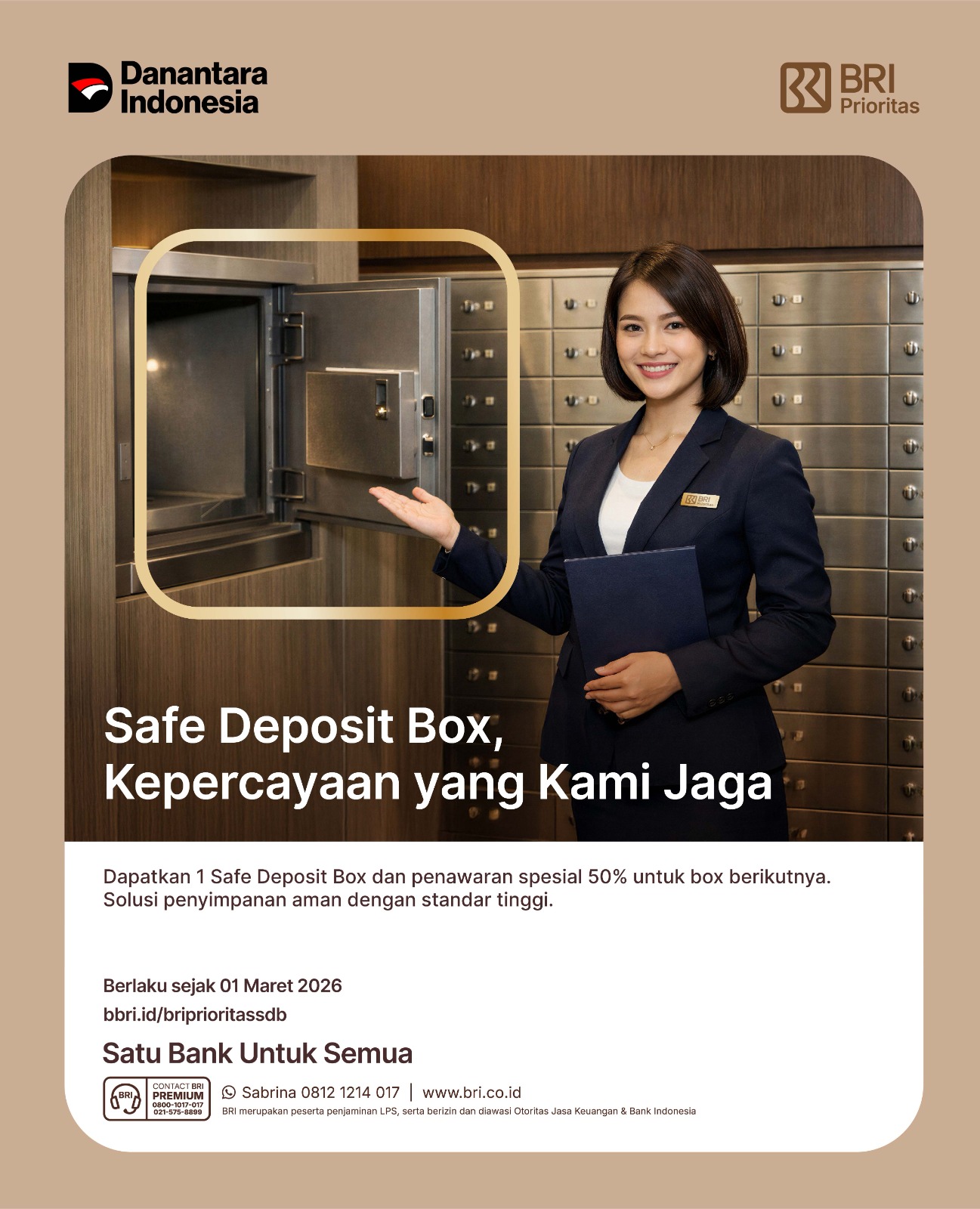

Safe Deposit Box

One (1) Safe Deposit Box is provided free of charge; subsequent boxes are subject to a 50% discount for all box sizes.

Additional Terms and Conditions

- Existing Safe Deposit Box renters who are classified as BRI Prioritas customers are entitled to a quota of one (1) box of the highest available type at no charge. For any additional boxes, a 50% tariff will apply across all box types.

- Please be advised that this revised policy will be effective from March 1, 2026.

Special hampers during festive holidays and birthday cakes on your special day — just for you and your family.

-

BRI Priority Customers with AUM ≥ IDR 1,000,000,000 (One Billion Rupiah)

-

Must have an active BRI Priority Debit Card at the time of service booking.

-

Based on the AUM CPM position at the time of service booking, the customer must hold the following products:

-

Savings/current account/deposit, and

-

Non-DPLK investment products or BAC Non-AM Products

-

- A minimum average 3 (three) months holding of Non-DPLK Investment Products (AUM) equivalent to at least IDR 25,000,000 (Twenty-Five Million Rupiah) or ownership of Non-AM Bancassurance Products based on the AUM CPM position at the time of service booking.

Tax Advisory

- Privilege "Tax Consultant” merupakan apresiasi berupa jasa konsultasi yang akan diberikan kepada Nasabah BRI Prioritas bekerja sama dengan perusahaan digital konsultan pajak yaitu PT Investa Hipa Teknologi (HiPajak)

- Privilege Tax Consultant dapat diberikan kepada Nasabah BRI Prioritas yang memiliki Total AUM ≥ Rp. 10 Milyar

- Privilege ini hanya dapat digunakan bagi Nasabah Ybs (tidak dapat diberikan kepada keluarga atau kerabat nasabah)

- Fasilitas yang akan diberikan kepada Nasabah BRI Prioritas oleh HiPajak antara lain yaitu Konsultasi, Analisa dan Pendampingan dalam memberikan solusi terkait perpajakan.

- Kegiatan konsultasi yang diberikan sebagai privilege, hanya dapat dilaksanakan secara online (melalui sarana zoom atau wa call) dengan durasi maksimal selama 30 (tiga puluh) menit.

Internet Banking Personal

Internet Banking Personal

Internet Banking Business

Internet Banking Business

Internet Banking Corporate

Internet Banking Corporate